The Fleet Safety Marketplace:

New Paradigm in Commercial Auto Insurance

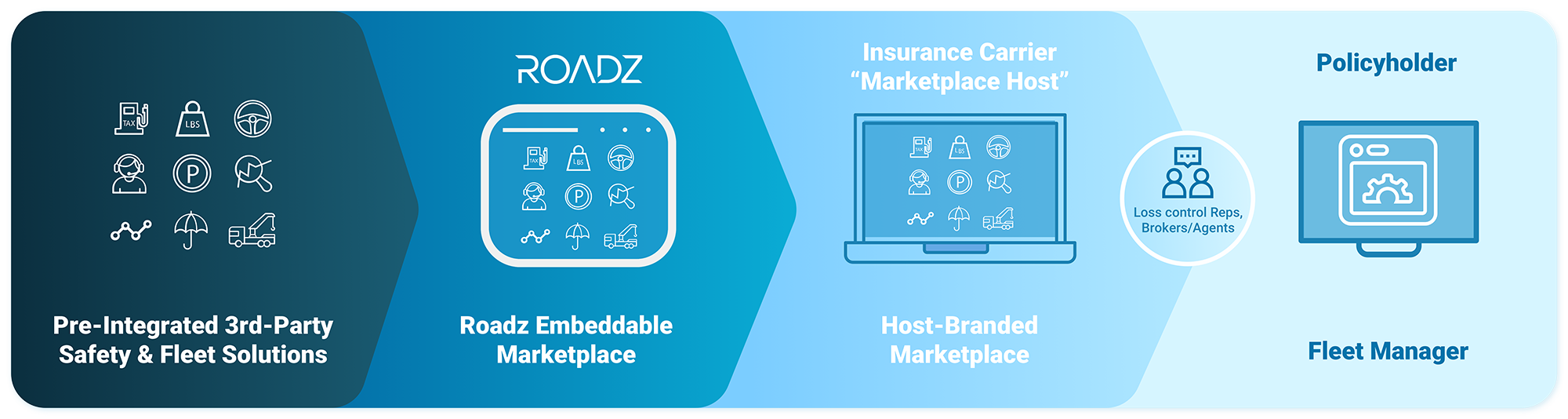

Fleet safety marketplaces are a new and exciting development in commercial auto insurance, brought about by the ROADZ marketplace platform.

Some of the leading insurance carriers in North America have recently launched marketplaces with safety and risk management solutions to achieve their goals:

Improve fleet safety and lower loss ratios.

Access fleet data to improves risk selection and pricing.

Increase customer engagement and loyalty.

Fleet safety marketplaces powered by Roadz can be launched within weeks with no development resources on your end.

Commercial Auto Insurers are Facing Big Challenges

Poor loss ratios and enormous nuclear verdicts have been challenging commercial auto insurers for about a decade, but in the last few years those challenges have become worse.

Succeeding as a commercial auto insurer requires finding ways to reduce loss ratios, use data to improve risk selection and pricing, improve claims adjusting, and keep good customers on board.

How can insurers achieve these goals and thrive?

Offer Your Customers a “Fleet Safety Marketplace”.

A Fleet Safety Marketplace – powered by Roadz, will help you address the challenges.

A Fleet Safety Marketplace – powered by Roadz, will help you address the challenges.

Improve Loss Ratios

In the last few years commercial auto insurers have been trying to engage safety technology providers to help reduce loss ratios. But engaging more than a handful of providers is challenging, and fleet customers, who are diverse, want Choice and Relevance when it comes to choosing and buying solutions.

Insurers are also struggling to find the resources and build the expertise to work with safety and risk management solution providers.

Launching a Roadz-powered Fleet Safety Marketplace increases adoption of safety and risk management technologies by insureds and cuts down on the resources associated with the ongoing management of technology partners.

Gain Access to Fleet Data

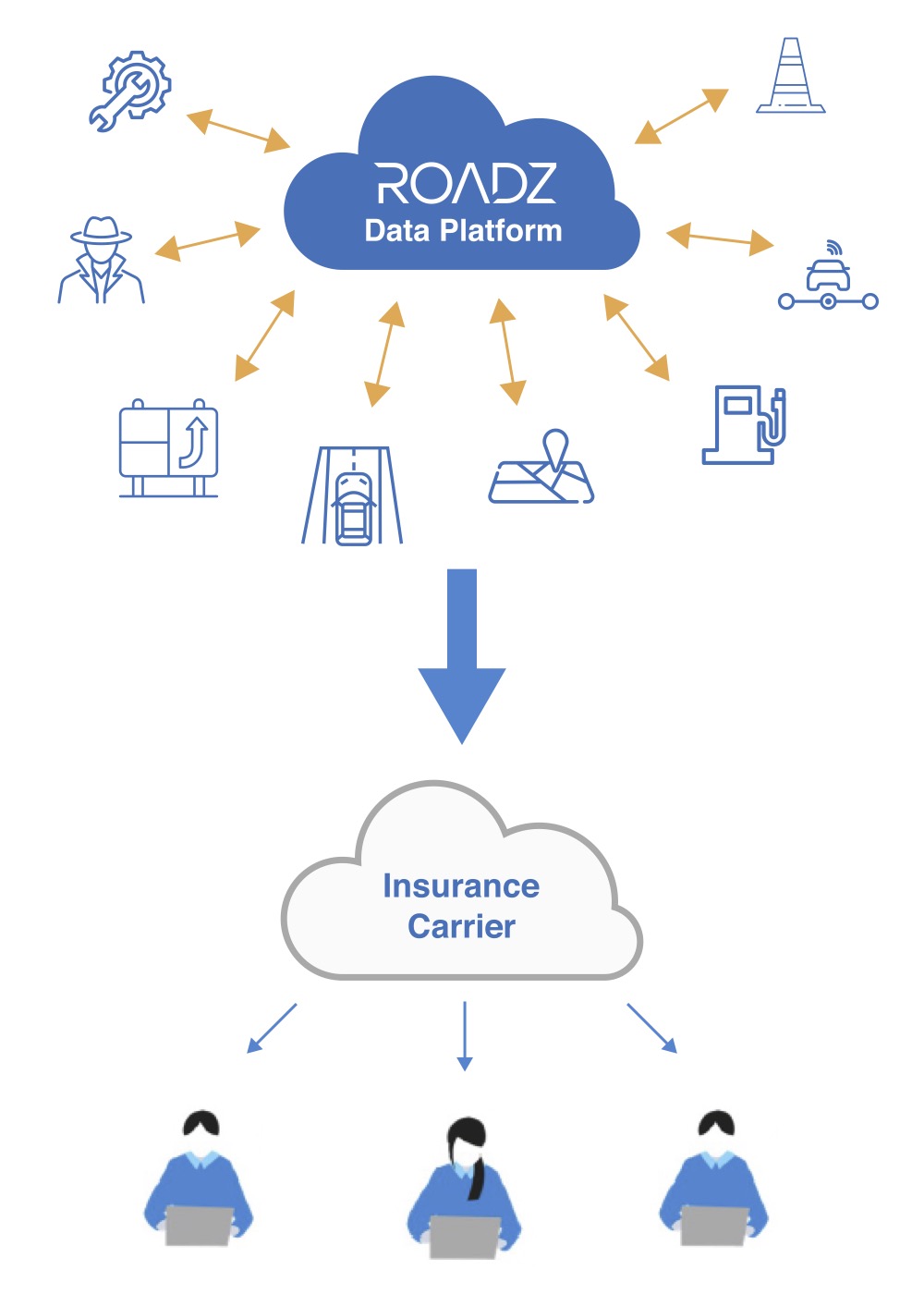

Launching a Roadz-powered marketplace provides insurance carriers access to data generated by the solutions offered through their marketplace.

Increase Customer Engagement and Loyalty

Very often, commercial auto insurers meet their customers only when it’s time to renew. There is very little ongoing customer engagement or added value provided during the policy term, so customer- stickiness is low. How to keep good customers on board?

A Fleet Safety Marketplace allows insurance carriers, brokers and agents to provide additional value and engage their insureds on an ongoing basis, with minimal resources. Customers get educated about new technologies and trends by the ecosystem of solution providers on your marketplace, through monthly webinars and newsletters crafted by Roadz especially for your customer base, in coordination with your marketing team.

Benefits For Your Customers.

- Discover curated solutions to improve safety

- Access solutions discounts and promotions

- Centralized access and unified billing

- End-to-end user experience

Launch a Marketplace within Weeks

Some of the leading insurance carriers in North America have already launched ROADZ-powered fleet safety marketplaces to achieve their goals. Join them to become an industry leader and offer a fully functional marketplace to allow your customers to browse, try, buy and access innovative safety and risk management solutions from your domain.

Building a robust marketplace and solution ecosystem is an enormous undertaking. Roadz does the heavy lifting for you. We can launch your marketplace within weeks, with no development resources required on your end. We handle data integration and normalization, partner management, legal agreements, and marketplace operations.